31 July 2006

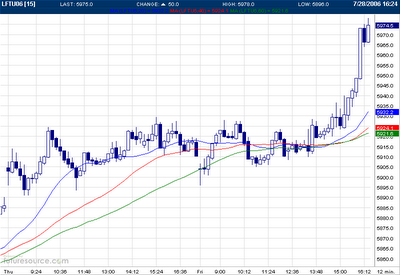

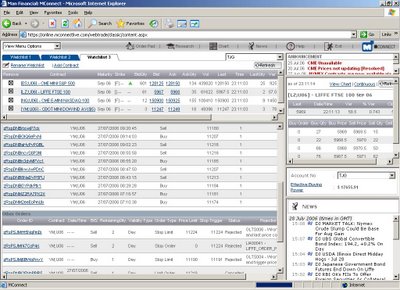

bot 11238 11238

Cut 11228 11228 using sell stop order since support or nl at 11229 was breached

Reflection: m50 100 200 not a bullish arrangement when buying

Index Futures - HSI (Hongkong Hangseng Index Futures Aug 06) (31 Jul 06)

Bot 17025

Cut 17010 since market near closing hours

Labels: Futures Trading

Bottom formation breakouts have increased to 12 for stocks on my radar so far, this may be an early sign of market further rebound to a tg of 2472 before wave C can proceed.

L26 Labroy Marine - nl 1.43, buy order not filled on 25/26/27/28/31 Jul 06

H78 HONGKONG LAND - db 3.34-3.80 tg 4.26, bot 3.82 on 24 Jul 06

G01 GES - db seems too small nl 1.05, not inetrested - a mistake, now (27 Jul 06) 1.22 due to Venture takeover offer of GES at 1.25

F33 FERROCHINA - db .56-.81 tg 1.06, bot 0.81 on 24 Jul 06, added 0.815 on 25 Jul 06, added .815 on 26 (?) Jul 06

D05 DBS - nl 18.2 tg 19.2 former high, bot 18.3 on 25 Jul 06, added 18.2 on 27 Jul 06, added 18.2 on 28 Jul 06, added 18.2 on 31 Jul 06

C56 CELESTIAL - db seems too small, tg 1.56 former rebound high, bot 1.42 on 25 Jul 06, high 1.54 on 27 Jul 06, close to tg 1.56, looking to take profit from tomorrow onwards, tg triggered, high 1.63 on 31 Jul 06

Y62 Sino Env - rising triangle .565-.94, new high, blueline theory mentioned by The Art of Growing Money, chart formation target (tg) 1.31, bot .95 on 27 Jul 06, added .945 on 27 Jul 06, added .94 on 27 Jul 06, buy order at .94 and .94 not filled on 28 Jul 06, added 0.955 on 31 Jul 06, high .985

F83 Cosco - 52 week new high, Another blue line stock

T48 Singtel - db breakout, tg 2.76, nl 2.55, bot 2.52 on 28 Jul 06, added 2.52 on 28 Jul 06 (another account), hihg 2.59 on 31 Jul 06

T03 TAT - db breakout, nl 1.03

S72 SC Global - 52 week new high, nl 1.52

J36 JMH - db breakout, nl 18.4, buy order not filled on 28/31 Jul 06

U11 UOB - bot 15.5 on 31 Jul 06 on expectation of breakout of nl at 15.7, which was not achieved today (31 Jul 06), tg 17, the 52 weeks high

F12 Fibrechem - db breakout long time ago, tg 1.43, historical high, bot 1.22 on 31 Jul 06

29 July 2006

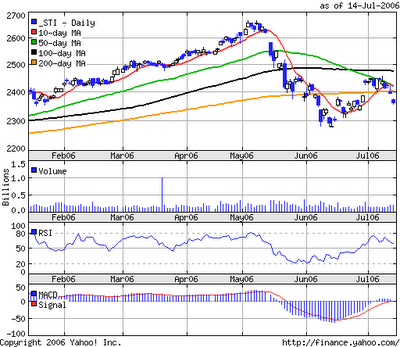

Weekly - morning star + inverted hammer, and a db formation is in the making

Daily - a db formation is in the making, nl 2450, db tg 2622 which exceeds 2517, the 61.8% rebound level of total loss from 2666 to 2278. Major bulls need to break out this nl 2450 with heavy volume to convince the market, wave c of wave B (consisting waves a b c, 3 waves in total) bear rally is in still progress. See charts below.

Weakest among the 3 major US indices.

Daily - MA 50 100 150 bearish arrangement, but a small db formation has been broken out without heavy volume, indicating a bear rally is ongoing, wave 2 (bear rally to MA 50 100) of wave C in progress?

Monthly - candles with long lower shadows for 2 months show that a bottom has been identified.

Weekly - Morning star + long cross, a db in place?

Daily - a db formation will be confirmed once 1282 is broken out with heavy volume

Comment : US markets are always surprisingly resilient. Feeling they are still the best places to trade in in the world.

Monthly - candles with long lower shadows for 2 months show that a bottom has been identified.

Weekly - Morning star + long cross, a db in place?

Daily - a db formation will be confirmed once 11300 is broken out with heavy volume

Comment : US markets are always surprisingly resilient. Feeling they are still the best places to trade in in the world.

28 July 2006

Bot 11174 11181 11181 11185 11207

Sold 11213 11207 11216 11216 11180(cut loss)

Bottom formation breakouts have increased to 12 for stocks on my radar so far, this may be an early sign of market further rebound to a tg of 2472 before wave C can proceed.

L26 Labroy Marine - nl 1.43, buy order not filled on 25/26/27/28 Jul 06

H78 HONGKONG LAND - db 3.34-3.80 tg 4.26, bot 3.82 on 24 Jul 06

G01 GES - db seems too small nl 1.05, not inetrested - a mistake, now (27 Jul 06) 1.22 due to Venture takeover offer of GES at 1.25

F33 FERROCHINA - db .56-.81 tg 1.06, bot 0.81 on 24 Jul 06, added 0.815 on 25 Jul 06, added .815 on 26 (?) Jul 06

D05 DBS - nl 18.2 tg 19.2 former high, bot 18.3 on 25 Jul 06, added 18.2 on 27 Jul 06, added 18.2 on 28 Jul 06

C56 CELESTIAL - db seems too small, tg 1.56 former rebound high, bot 1.42 on 25 Jul 06, high 1.54 on 27 Jul 06, close to tg 1.56, looking to take profit from tomorrow onwards

Y62 Sino Env - rising triangle .565-.94, new high, blue sky theory mentioned by The Art of Growing Money, target (tg) 1.31, bot .95 on 27 Jul 06, added .945 on 27 Jul 06, added .94 on 27 Jul 06, buy order at .94 and .94 not filled on 28 Jul 06

F83 Cosco - 52 week new high, Another blue line stock

T48 Singtel - db breakout, nl 2.55, bot 2.52 on 28 Jul 06, added 2.52 on 28 Jul 06 (another account)

T03 TAT - db breakout, nl 1.03

S72 SC Global - 52 week new high, nl 1.52

J36 JMH - db breakout, nl 18.4, buy order not filled on 28 Jul 06

27 July 2006

Bottom formation breakouts have increased to 8 stocks on my radar so far, this may be an early sign of market further rebound to a tg of 2472 before wave C can proceed.

L26 Labroy Marine - nl 1.43, buy order not filled on 25/26/27 Jul 06

H78 HONGKONG LAND - db 3.34-3.80 tg 4.26, bot 3.82 on 24 Jul 06

G01 GES - db seems too small nl 1.05, not inetrested - a mistake, now (27 Jul 06) 1.22 due to Venture takeover offer of GES at 1.25

F33 FERROCHINA - db .56-.81 tg 1.06, bot 0.81 on 24 Jul 06, added 0.815 on 25 Jul 06, added .815 on 26 (?) Jul 06

D05 DBS - nl 18.2 tg 19.2 former high, bot 18.3 on 25 Jul 06, added 18.2 on 27 Jul 06

C56 CELESTIAL - db seems too small, tg 1.56 former rebound high, bot 1.42 on 25 Jul 06, high 1.54 on 27 Jul 06, close to tg 1.56, looking to take profit from tomorrow onwards

Y62 Sino Env - rising triangle .565-.94, new high, blue sky theory mentioned by The Art of Growing Money, target (tg) 1.31, bot .95 on 27 Jul 06, added .945 on 27 Jul 06, added .94 on 27 Jul 06

Cosco - Another blue sky stock

25 July 2006

Double bottom formation breakouts of 6 stocks on my radar so far, this may be an early sign of market further rebound to a tg of 2472 before wave C can proceed.

L26 Labroy Marine - nl 1.43, buy order not filled on 25 Jul 06

H78 HONGKONG LAND - db 3.34-3.80 tg 4.26, bot 3.82 on 24 Jul 06

G01 GES - db seems too small nl 1.05, not inetrested

F33 FERROCHINA - db .56-.81 tg 1.06, bot 0.81 on 24 Jul 06, added 0.815 on 25 Jul 06

D05 DBS - nl 18.2 tg 19.2 former high, bot 18.3 on 25 Jul 06

C56 CELESTIAL - db seems too small, tg 1.56 former rebound high, bot 1.42 on 25 Jul 06

20 July 2006

Mediaring - added positions at 0.34, BTW just saw that CLSA had a tg of 0.40

Other long orders queued 1 to 3 bids above yesterday's close - not filled, do not want to chase too hard. Bear in mind, this is not a tradable bounce. Better wait for many bottom formations to appear and break out with heavy volume before buying.

STI - A bear rally? close to strong resistance at 2400.

US indices - A bear rally? close to resistances.

19 July 2006

Mediaring - Bot a little bit at .335 to test the market. Not time to buy since no bottoming signs seen yet. Majority of my sodiers (trading capital) are still standing by.

Index futures trading paused for now since skills are not mature yet on this and it is time-consuming and without much potential of return and chart is not live, which is unfavorable for trading decision making.

Sold half Ausgroup on Mon at .275.

16 July 2006

STI TA (16 Jul 06)

Island reversal top formation confirmed.

Any minor techncial rebound, if any, will be capped by 2400

Major support 2278, watch closely!

Wave B may have completed, which will be confirmed once 2278 is taken out by bears

Wave C may have started, which will be confirmed once 2278 is taken out by bears

A head and shoulder top foramtion (shs) on the weekly chart will be confirmed once 2278 is taken out by bears, minimum technical target will be around 1900, scary?

15 July 2006

Maybe a good long candidate after market storm.

STI

A small double top (dt) has been broken down effectively.

NL 2400 will cap any short term technical rebound.

Wave C may have started.

Plan: Not suitable for buy or bottom fishing until a bottom formation forms and breaks out with heavy volume.

Nasdaq

Wave C started since its wave A (consisting of 5 impusive down waves) low has been broken down.

Strategy

Continue playing FTSE 100 futures and Mini Dow futures at night time until more than 50 stocks in SGX establish bottom formations and break out with heavy volumes.

Monitor indices all over the world closely.

Monitor existing 115 stocks on my radar screens closely. Read their daily charts on daily basis at night time.

See earlier posting for Chart.

Despite all the loss making trades earlier, I was still looking for a profitable trade. Surprise to me, it turned out to be a heavier loss making trade this time.

Shorted at 10782, reason: a small dt (nl 10780) breakdown under m50100200 bearish arrangement which proved to be a false breakdown later.

Covered at 10812 using market order, losing 30 points, the reason is that Mini Dow rose in form of 5 impusive waves and I became panic and used a market order to cover back shorted position. Luckily, I only shorted 1 contract!

Overall, I paid learning fees of S$339 including trading loss of US$60 and commissions for 8 trades of FTSE 100 (8 British pounds per trade) and 4 trades of Mini Dow (US$8 per trade), and delayed a few hours of my sleeping time. Believe the initial market testing is enough for me. From now on, I'll put on some profitable trades based on my knowledge and skills in the market for more than ten years, hopefully!

Happy trading, TopTrader!

Labels: Futures Trading

Longed at 10788 at around 10:00 in the chart, reason: 5 wave down, expect a technical rebound though realising that m50 100 200 bearish arangement, continue to drop to 10751 before a rebound

Cut at 10787, 5th wave dropped to 10751 which is deeper than expected before rebounding. reason: rebounded and close to m50, m50100200 on 1 min chart still displayed a bearish arrangement.

Reflection: Not a good trade decision. 1 min chart m50100200 bearish arrangement, and are still trending down, a bottom formation has not formed, decision was based on E wave only, a gut feeling, which is not objective, the odds are not on my side. However, loss cut was executed well. Looks like I have to pay more learning fees before a profitable trading.

Labels: Futures Trading

Although there were opportinities in FTSE 100 Futures (opens 3pm Sin time and trades until 11:29pm Sin time) in the later part of the day when US market opened at around 9pm Sin time, I switched to Mini Dow US$5, because I found that FTSE 100 was merely another follower, rather than a leader, same as STI and most other indices all over the world, they follow US indices very closely, ie, Dow 30, SP 500 and Nasdaq 100. I'd better off trading a leader, rather than a follower. But before 9pm Sin time we have to trade FTSE 100, which offers best liquidity and time frame for a part-time trader who has a daytime office job. I get this conclusion after comparing trading time frames of all availabe indices futures .

Labels: Futures Trading

14 July 2006

FTSE 100 Futures 2nd Frade - Failed (14 Jul 06)

Longed at 5750.5 added long at 5747, reason : db breakout and m10 20 40 bullish arrangement

Long positions closed (sold) at 5748, reason: dt breakdown and m10 20 40 bearish arrangement cut loss when rebounding to dt nl at 5748

Reflection: While closing short positions is wise in the FTSE 100 maiden trade mentioned earlier in such a set up or situation, but should not have longed at all after that at this stage since m50 100 200 had not formed bullish arrangement though m10 20 40 are bullish arrangement which is not reliable until m50 100 200 form bullish arrangement. This is the relationship between m10 20 40 and m50 100 200, i.e., their arrangements must be the same, directions must be the same (either up or down), and preferably coupled with a chart pattern such as db (breakout for long) and dt (breakdown for short), only until then a potential profitble trade is possible.

Summary:

Long - 1 min chart m50 100 200 bullish arrangement and m10 20 40 bullish arrangement and bottom formation breakout

Short - 1 min chart m50 100 200 bearish arrangement and m10 20 40 bearish arrangement and top formation breakdown

Chart - Use 1 min chart for day trading, use 5 min chart coupled with its m50 100 200 to confirm trend.

Plan - Look for quality trading opportunities only based on "Summary", ignore noises.

Labels: Futures Trading

FTSE 100 Futures Day Trading - Maiden Trade on 14 Jul 06

(Today 14 is not a good day, not supposed to start maiden futures trade)

Shorted at 5758 m10 20 40 bearish arrangement

Shorted (Added) at 5752.5 symmetrical triangle breakdown

Short positions closed at 5752, reason: db breakout and m10 20 40 bullish arrangement

Result: small profit after deducting 32 British Pounds of commission for 4 times of trades for 2 contracts

Reflection : Should have covered back at around 5740 based on symmetrical triangle breakdown target. Greed led to late covering of positins until a db formed and breakout.

Comment to trading platform: Chart delays 21 minutes for FTSE 100 (Mini Dow delays 5 minutes only) in most of the maiden trading process, which is not favorable for trading decision. Broker indicates it is doing something on this so that we can get live charts. This is good news for day trader. Until then, m10 20 40 may have no much value. I switched quickly back to m50 100 200, coupled with chart pattern after I realized this point so as to get big better picture on trend of FTSE 100.

Labels: Futures Trading

13 July 2006

US Market Hourly Charts 5 Waves Down - DOW 30, SP 500 and Nasdaq

Hinting :

1 Market bear rally or sucker rally or Wave B rebound may have completed

2 Wave C may have initiated

3 A minor technical rebound is possible in short term, which is not tradable, too short

Strategy : Sell / cut remaining positions, if any, during minor technical rebound, start day trading FTSE 100 futures at night time from 6pm to 11pm.

Labels: Futures Trading

06 July 2006

Stocks Update (06 Jul 06)

Shortlisted candidates for participation of wave c (up) of wave B

(Select pre-conditions - price 5 up waves, corresponding volumes 5 up waves):

T16 CHINA DAIRY --- bot .57 .575 .58 on 30 Jun 06 rebound 50% of total fall tg .628, high .615, sold .595 .60 .605 on 06 Jun 06

M09 MEDIARING --- bot .375 on 30 Jun 06 rebound 50% of total fall tg .445, sold .41 .415 on 06 Jul 06

I04 XPRESS --- bot .165 on 30 Jun 06 rebound 50% of total fall tg .22,

high .175, cut .16 .165 on 06 Jul 06

I54 FABCHEM --- bot .575 .58 .585 on 30 Jun 06 rebound 50% of total fall tg .593, upside limited, high .63 Temporary halt, what's happening?, sold .735 (Sell Queue at .705 .71 .715)on 06 Jul 06

G54 CHINA ESSENCE --- bot .595 .60 .605 on 30 Jun 06 rebound 50% of total fall tg.595, tg exceeded, high .625, sold .605 .61 .615 on 06 Jul 06

W81 SKY CHINA --- bot .415 .42 .425 on 30 Jun 06 rebound 50% of total fall tg .473, high .44, sold .46 .46 .465 .47 (queue .455 .46 .465 .47) 06 Jul 06

F53 CHINA HONG --- buy order 1.51 not filled on 30 Jun 06

B49 BRIGHT WORLD --- bot .495 .50 .505 on 30 Jun 06 rebound 50% of total fall tg .545 iocbc FA tg .60, high .51, cut .495 .50 .505 on 06 Jul 06

L46 LUZHOU --- bot .735 .74 on 30 Jun 06 rebound 50% of total fall tg .81, high .81, tg triggered, sold .795 .80 .805 on 06 Jul 06

J31 JIU TIAN --- bot .605 .61 .615 on 30 Jun 06 rebound 50% of total fall tg .593, tg exceeded, high .63, sold .615 .62 .625 on 06 Jul 06

I85 HENG XIN --- bot .505 .51 .515 on 30 Jun 06 rebound 50% of total fall tg .473, tg exceeded,high .535, cut .51 .515

M32 MIDMOUTH --- bot .52 on 30 Jun 06 db tg .56, rebound 50% of total fall tg .598, high .57, sold .575 .58 on 06 Jul 06

S11 SSH --- bot .26 .265 .27 on 30 Jun 06 rebound 50% of total fall tg .278, upside limited, high .275, sold .265 .27 .275 on 06 Jul 06

So far, only 2 stocks in hand : Ausgroup (nobody took it today at .31 and .32) and Kian Ann, a dead cat.

05 July 2006

China Plays - As mentioned yesterday that wave c of wave B started and some China plays are likely to probe historical highs in coming days when it will be a perfect opportunity to take profit and liquid all long positions!

Shortlisted candidates for participation of wave c (up) of wave B

(Select pre-conditions - price 5 up waves, corresponding volumes 5 up waves):

T16 CHINA DAIRY --- bot .57 .575 .58 on 30 Jun 06 rebound 50% of total fall tg .628, high .615, high .625 tg almost reached

M09 MEDIARING --- bot .375 on 30 Jun 06 rebound 50% of total fall tg .445, high .42

I04 XPRESS --- bot .165 on 30 Jun 06 rebound 50% of total fall tg .22

high .175, high .17

I54 FABCHEM --- bot .575 .58 .585 on 30 Jun 06 rebound 50% of total fall tg .593, upside limited, high .63 Temporary halt, what's happening? High .73

G54 CHINA ESSENCE --- bot .595 .60 .605 on 30 Jun 06 rebound 50% of total fall tg.595, tg exceeded, high .625, high .635

W81 SKY CHINA --- bot .415 .42 .425 on 30 Jun 06 rebound 50% of total fall tg .473, high .44, high .485, tg triggered

F53 CHINA HONG --- buy order 1.51 not filled on 30 Jun 06

B49 BRIGHT WORLD --- bot .495 .50 .505 on 30 Jun 06 rebound 50% of total fall tg .545 iocbc FA tg .60, high .51, high .525

L46 LUZHOU --- bot .735 .74 on 30 Jun 06 rebound 50% of total fall tg .81, high .81, tg triggered, high .835, tg triggered again

J31 JIU TIAN --- bot .605 .61 .615 on 30 Jun 06 rebound 50% of total fall tg .593, tg exceeded, high .63, high .655

I85 HENG XIN --- bot .505 .51 .515 on 30 Jun 06 rebound 50% of total fall tg .473, tg exceeded,high .535, high .535

M32 MIDMOUTH --- bot .52 on 30 Jun 06 db tg .56, rebound 50% of total fall tg .598, high .57, high .60, both tgs triggered

S11 SSH --- bot .26 .265 .27 on 30 Jun 06 rebound 50% of total fall tg .278, upside limited, high .275, high .275, tg almost reached

http://toptrader.blogspot.com/

04 July 2006

China Plays - wave c of wave B started today! Some China plays are likely to probe historical highs in coming days when it will be a perfect opportunity to take profit and liquid all long positions!

Shortlisted candidates for participation of wave c (up) of wave B

(Select pre-conditions - price 5 up waves, corresponding volumes 5 up waves):

T16 CHINA DAIRY --- bot .57 .575 .58 on 30 Jun 06 rebound 50% of total fall tg .628, high .615

M09 MEDIARING --- bot .375 on 30 Jun 06 rebound 50% of total fall tg .445

I04 XPRESS --- bot .165 on 30 Jun 06 rebound 50% of total fall tg .22

high .175

I54 FABCHEM --- bot .575 .58 .585 on 30 Jun 06 rebound 50% of total fall tg .593, upside limited, high .63 Temporary halt, what's happening?

G54 CHINA ESSENCE --- bot .595 .60 .605 on 30 Jun 06 rebound 50% of total fall tg.595, tg exceeded, high .625

W81 SKY CHINA --- bot .415 .42 .425 on 30 Jun 06 rebound 50% of total fall tg .473, high .44

F53 CHINA HONG --- buy order 1.51 not filled on 30 Jun 06

B49 BRIGHT WORLD --- bot .495 .50 .505 on 30 Jun 06 rebound 50% of total fall tg .545 iocbc FA tg .60, high .51

L46 LUZHOU --- bot .735 .74 on 30 Jun 06 rebound 50% of total fall tg .81, high .81, tg triggered

J31 JIU TIAN --- bot .605 .61 .615 on 30 Jun 06 rebound 50% of total fall tg .593, tg exceeded, high .63

I85 HENG XIN --- bot .505 .51 .515 on 30 Jun 06 rebound 50% of total fall tg .473, tg exceeded,high .535

M32 MIDMOUTH --- bot .52 on 30 Jun 06 db tg .56, rebound 50% of total fall tg .598, high .57

S11 SSH --- bot .26 .265 .27 on 30 Jun 06 rebound 50% of total fall tg .278, upside limited, high .275

http://toptrader.blogspot.com/

01 July 2006

Volume analysis shows that there are too many hesitating positions in the market. Expect some consolidation or positions flushing by major bulls before further rebound.

Note monthly chart - 5 up waves have completed. Some form of major correction has to come sooner or later, meaning, be cautious, do not be carried away by current market technical rebound.

Yes, the breakout is clear. But encountered resistances at m50 and m150, another resistance is 1290. Index is likely to consolidate in short term before finding fresh strength to forge ahead. Is 1290 the end of the bear rally? The advice is that do not be too greedy.

Weekly chart is still healthy.

Monthly chart shows clearly 5 up waves have completed. A major correction has to come following them sooner or later based on Elliot Wave Theory.

Nasdaq daily chart - DB breakout with volume, but likely to consolidate in short term since volume is heavier when Nasdaq corrected on the next day after breakout, demonstrating that there are many hesitating positions in the market. Major bulls need to flush out those hesitating positions first before they can forge ahead, indicating by swift volume contractions during expected correction towards db neckline.

Note that Nasdaq fell starting from May 06 in form of 5 down waves, hinting that bear market is in place and wave A had completed at around 2060, recent low. 2310 is the maximum level the expected technical rebound or sucker rally or wave B can reach. Note there is a shs sitting above there. Do not expect too much.

FTSE 100 and Nikkei 225 - has similar chart pattern to Nasdaq, 5 down waves, indicating a long term bear market is in place and a technical rebound is in progress at this moment.

STI Daily chart - Double bottom formation (db) has been broken out on the upside and confirmed by heavy volume and breakaway gap on the breakout day. RSI and Macd support this view, too. The gap is a breakaway gap because there is a double bottom formation below this gap and volume is heavy on the gap day. Upside resistance resides at m50 and m100 at around 2473, matching with 50% of rebound of total fall from 2666 to 2278. In short term, STI is likely to consolidate at around current level, even close part of the breakaway gap before taking out resistance at 2473.

Market sentiment turned bullish abruptly for US market even before US Fed FOMC result / decision was out. Also noticed that Dow 30, Nasdaq and S & P 500 formed double bottoms and broke above db necklines respectively with heavy volumes on the breakout day, indicating validity of breakouts.

I was forced to reverse my bearish view (indicated by mass selloff in recent days) and take decisive actions by mass buying. I did not think too much and scrambled to queue to buy those counters listed below as planned in advance at prices 1 to 3 bids above previous closes in early morning before SGX opening on 30 Jun 06, Fri.

On hindsight, the mass selloff was not timed well. The only solace is that I have got rid of those weak stocks and replaced them with the strongest ones, which is not bad after all.

Nontherless market action on 30 Jun 06 shows that performance of China plays was muted comparing with general market. Technical charts show that most of them continue to consolidate at around current levels. Will this pose a potential concern?

Shortlisted candidates for participation of wave c (up) of wave B

(Selection conditions - price 5 up waves, corresponding volumes 5 up waves):

T16 CHINA DAIRY --- bot .57 .575 .58 on 30 Jun 06 rebound 50% of total fall tg .628

M09 MEDIARING --- bot .375 on 30 Jun 06 rebound 50% of total fall tg .445

I04 XPRESS --- bot .165 on 30 Jun 06 rebound 50% of total fall tg .22

I54 FABCHEM --- bot .575 .58 .585 on 30 Jun 06 rebound 50% of total fall tg .593, upside limited

G54 CHINA ESSENCE --- bot .595 .60 .605 on 30 Jun 06 rebound 50% of total fall tg.595, tg exceeded

W81 SKY CHINA --- bot .415 .42 .425 on 30 Jun 06 rebound 50% of total fall tg .473

F53 CHINA HONG --- buy order not filled on 30 Jun 06

B49 BRIGHT WORLD --- bot .495 .50 .505 on 30 Jun 06 rebound 50% of total fall tg .545 iocbc FA tg .60

L46 LUZHOU --- bot .735 .74 on 30 Jun 06 rebound 50% of total fall tg .81

J31 JIU TIAN --- bot .605 .61 .615 on 30 Jun 06 rebound 50% of total fall tg .593, tg exceeded

I85 HENG XIN --- bot .505 .51 .515 on 30 Jun 06 rebound 50% of total fall tg .473, tg exceeded

M32 MIDMOUTH --- bot .52 on 30 Jun 06 db tg .56 rebound 50% of total fall tg .598

S11 SSH --- bot .26 .265 .27 on 30 Jun 06 rebound 50% of total fall tg .278, upside limited